1.Current situation of sea freight

1.1 Sea freight rates continue to rise

Take our company for example, our factory near Fuzhou port and Xiamen port.

FUZHOU -Los Angeles achieve USD15,000/18,700

Xiamen-CARTAGENA,CO achieve USD12,550/13,000.Before the Covid-19,there were no more than USD2,400/40HC.

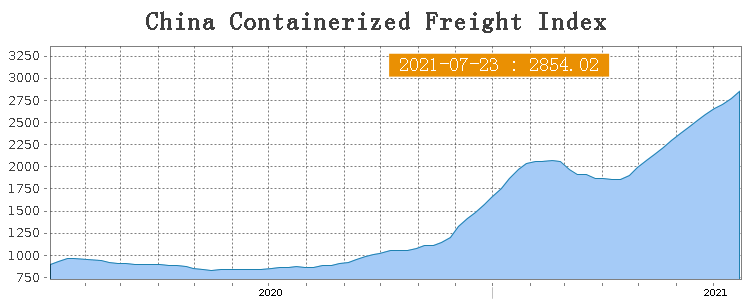

CCFI, this index objectively reflects the fluctuation of the freight rate in China’s container export shipping market.

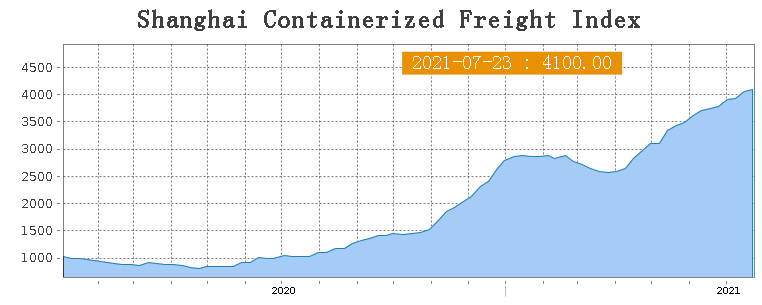

The latest edition of the Shanghai Containerized freight Index (SCFI) has broken the 4,000 mark for the first time.

The index has been below 1,000 for most time in the past decade, but this year keeping breaking records, break 3,000 mark in May, and achieve 4100 on July.23th.

Under backdrop of exceptionally strong DEMAND in the USA and heavy congestion at ports around the world, the index shows few signs of abating.

1.2 Freight rates are creeping up not just freight only, but also through various fee.

July has not passed, the shipping company began in August and another round of price rise, the shipping company is also becoming multifarious. In addition to the previous surcharge (GRI), peak season surcharge (PSS), this time also introduced a new charge – value-added charge (VAD)

Hapeg-Lloyd: Effective August 15, a Value Added surcharge (VAD) will be levied on Chinese exports to the U.S. and Canada at U.S. and Canadian destinations. We charge you an extra $4,000 for a 20-foot container and $5,000 for a 40-foot container.

MSC: From 1st September, the cancellation charge will be levied on goods exported from South China and Hong Kong to USA and Canada. The details are as follows:

USD 800/20 dv; USD 1000/40 dv;

USD 1125/40 hc; USD 1266/45 ‘

1.3 Even get ship space by high freight rate, one container still hard to get.

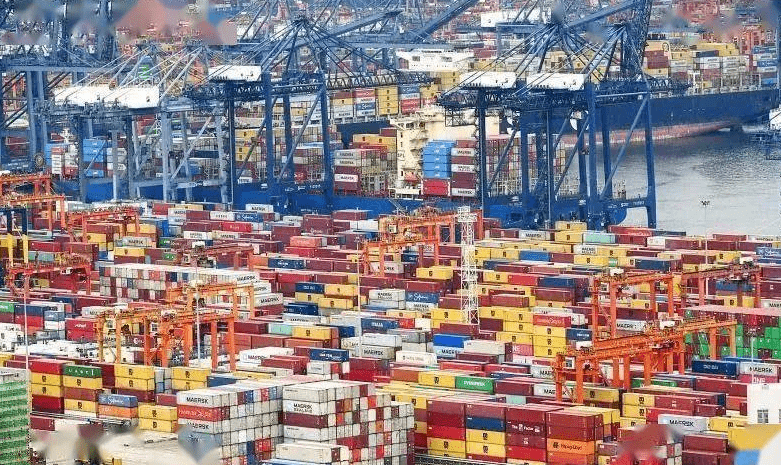

In most of China’s terminals, a serious lack of containers has last for long, which has led to a rise in the cost of sea exports.

In a word, current sea freight problem are:

–Shipping voyage time extend

–freight rate is too high,

–export container hard to get.

2.Why freight rate keeping increse ?

Supply has not catching up with demand

For the current container market, the most realistic problem is that the container that can be used repeatedly in the past can not be used repeatedly now.

Since the beginning of this year, China’s export volume continues to rise, export container demand surge, domestic container demand is tight, and with the easing of the epidemic in Europe and the United States, import demand is rapidly recovering, at the same time, the port loading and unloading force is insufficient, a large number of containers piled up at the port, overseas empty container turnover is generally slow, there is no time to repatriate to meet the demand. Shipping capacity is tight and freight rates continue to rise.

116 ports reported congestion

The word “congestion” is frequently mentioned. Port congestion has spread to major ports around the world, with more and more container ships waiting for berths on five continents.

A map released by SeapExplorer on Jul.22nd, highlights the current ultra-high pressure scenario at container ports around the world.

At this present, 328 ships were stranded at ports, and 116 ports reported problems such as congestion.

Europe’s main ports are in gridlock

Traffic jams in west U.S. ports continue to break records

Since March, congestion in the west Port of the United States has not improved. For example, from January to May 2021, Los Angeles and Long Beach had an average of 53.9 container ships per day, including those berthing and anchored, 3.6 times the pre-COVID-19 level.

The possibility of monopolistic factors cannot be ruled out.

3 global shipping alliances control 80% of the shipping market.

2M Alliance: Core members: ①Maersk ②MSC

Ocean Alliance: Core members: ① OOCL② COSCO③ EMC④ CMA Group (including ANL, APL)

THE Alliance: Core members: ① ONE (composed of MOL, NYK, Kline) ② YML ③ HPL(+UASC)

Speaking of which, a series of problems, such as the shortage of containers and ships, are ultimately caused by the different recovery of countries in the world under the epidemic. These problems will be well resolved when the global economy stabilizes.

We advise our overseas fellow partners:

- Pay attention to changes of sea freight rates. Make purchasing schedule in advance to against fluctuating sea freight.

- For partners who often use FOB terms, if you need,we can also ask our local freight forwarder agents for freight solution to help customers assess.

——Written by: Mason Xue

Post time: Jul-24-2021